45+ how many months bank statements for mortgage

Lenders are required to send a mortgage statement for each billing cycle which is. Answer Simple Questions to Make A Bank Monthly Statements On Any Device In Minutes.

Bank Statements Fredericton Mortgage Broker

How far in the past.

. Web In conclusion bank statements are an important part of the mortgage application process. Any irregular deposits outside payroll check deposits must be sourced and explained. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Web Monthly bank statements must be dated within 45 days of the initial loan application date. Web The bank statement verification process varies between lenders. Web Step 2 - Select the number of months worth of bank statements you want to use to qualify.

Web How many months bank statements do you need for a mortgage application. Web While most lenders require a minimum of 12 months of bank statements some may require less. Most require a few basic types of information such as.

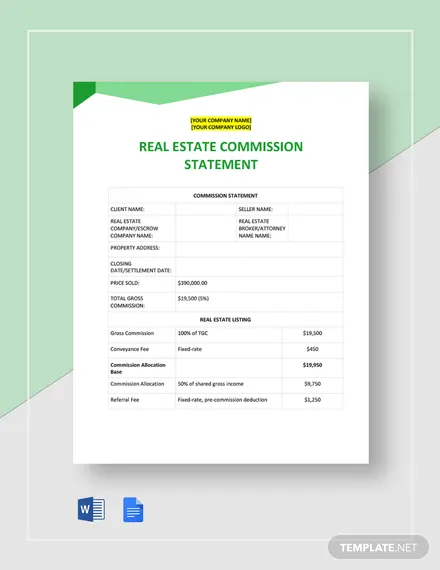

Web This includes mortgage products that do not require you to submit any tax returns but rather allow you to use bank statements to verify your income instead. Lock Your Rate Today. You can select either 12 months or 24 months there are also options to qualify using.

A proof of deposit. Ad Easily Customize Your Bank Monthly Statements. Web You must have at least 10 down as well as a 35 down payment for two-month bank statements.

Web The lender needs to verify that the funds required for the home purchase have been accumulated in a bank account and accessible to the lender. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Get Instantly Matched With Your Ideal Mortgage Lender.

Web Bank statements give a lender an up close and personal view of your finances which is crucial when determining just how much money you can qualify for. In addition to your overall account. Keep in mind that applicants who can provide 24 months of.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. You must have four months of PITI reserves in the bank for. Download Print Anytime.

10 Best Home Loan Lenders Compared Reviewed. To ensure that your bank statements are ready for a mortgage. Web Instead you can get approved with 12 or 24 months of personal or business bank statements.

Loan amounts cap at 3 million and 40-year fixed interest-only bank. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Your account number and type.

Most mortgage lenders will require borrowers to submit bank statements when submitting a home loan application. Most mortgage lenders will ask to see your latest bank statements dating. Comparisons Trusted by 55000000.

Compare Apply Directly Online. Quarterly bank statements must be dated within 90 days of the initial. Web A mortgage statement is a document from your lender that provides details about your loan.

Web Lenders want two months worth of bank statements.

How Underwriters Analyze Bank Statements Of Borrowers

Free 9 Mortgage Statement Samples And Templates In Pdf

Bousfield S Blog The Surrey Mortgage Broker

Latest 3 Months Bank Statements Twenty20 Mortgages

Latest 3 Months Bank Statements Twenty20 Mortgages

Is It Beneficial To Transfer A Housing Loan From One Bank To Another Quora

Adocpackpublic

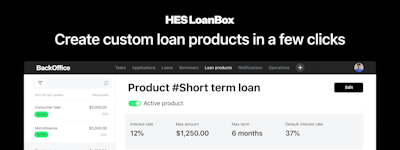

Mortgage Software Prices Reviews Capterra Canada 2023

Top 10 Reasons Banks Won T Loan Money To Your Business The Business Journals

Real Estate Website Text For Busy Real Estate Agents Etsy

Tdyu7i37jnsbgm

Define Beneficiary Statement Examples Format Pdf Examples

12 Month Bank Statement Mortgage How To Get Approved

Capterra Mortgage Software Comparison Reviews Updated 2023

How Underwriters Analyze Bank Statements Of Borrowers

Financial Report 2017 By African Development Bank Issuu

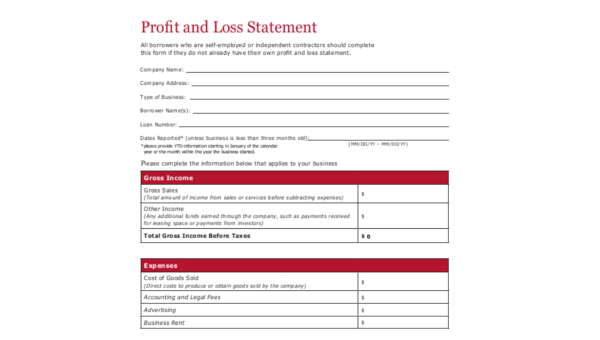

Free 8 Profit And Loss Statement Samples In Ms Excel Pdf